Executive Search 101 - Part 2: Who's Really Choosing the Next CFO? Decoding the Players in the six-figure+ Market

In our last article, we established that most senior finance roles (six-figure+) operate within a 'hidden job market,' managed through exclusive, retained executive search processes. But when your phone rings with a potential opportunity, who is actually driving that search?

While external headhunting firms are often the most visible face of executive search, the reality, particularly within larger organisations and increasingly - the private equity sector, is more nuanced. Understanding the different players involved is key to navigating your career at this level.

1. The External Maze: Navigating the Headhunters

Broadly speaking, external executive search firms fall into distinct categories. On one end are global generalists with dedicated CFO practices—commonly referred to as SHREK firms (more details on these in our next article). At the opposite end are specialised vertical firms that concentrate solely on finance placements, some at all levels of the value chain. Between these extremes sit various mid-sized “boutiques” and independent consultants, each carving out niches based on sector, company type, or specific finance disciplines.

However, the specialisations of individual consultants are often less clear-cut than they seem. A consultant with credentials mostly in mid-cap construction CFO roles might pop up leading the search for a large-cap FMCG Director of FP&A. This fluidity makes pinpointing the right contact challenging. In short, navigating this fragmented landscape, and identifying the right point of contact is often far from straightforward.

2. The Internal Powerhouse: Corporate Executive Talent Teams

A major shift in recent years, especially within large-cap businesses, is the rise of sophisticated internal executive talent acquisition teams. Don't underestimate their influence.

Scale & Scope: Companies like Amazon, Google, Apple boast internal search teams that rival external firms in headcount and capability. UK giants like Tesco and Vodafone (where I previously managed senior hiring practices) are increasingly staffing up in this area. In fact search fees are such a significant business cost that more and more companies are developing internal capability at this level.

Mandate: These internal teams often handle the bulk of senior hiring within a significant salary band. At Tesco, for example, the internal team was typically responsible for roles within the "Top 500" leadership group – covering basic salaries roughly from £150,000 up to £400,000.

So, when do these large organisations typically engage external search firms?

Executive Committee & Board Roles: The very highest echelons often demand external objectivity.

Strict Confidentiality: Replacing an incumbent discreetly would likely necessitate an external partner.

Highly Niche Skills: Sourcing rare or highly specialised expertise can trigger an exploration of external providers.

International Needs: Finding local leadership in overseas markets might be a reason to partner with a consultant “on the ground”.

The Relationship Factor: Crucially, business realities often trump policy. Pre-existing, trusted relationships between specific hiring managers (e.g., the Group CFO or CEO) and partners at external firms frequently lead to them being mandated, even for roles the internal team could theoretically handle.

3. The Private Equity Influence: Investor Talent Partners

A third player shapes the landscape for businesses under private equity or venture capital ownership.

Investor-Led Searches: While smaller portfolio companies might use external firms (sometimes directed by their PE investors), the larger PE and VC houses often have their own dedicated internal talent partners or teams.

Portfolio Needs: Given the frequent need for rapid leadership assessment, C-suite changes, and talent upgrades across multiple portfolio companies, these PE talent specialists play a direct, hands-on role in recruiting senior finance leaders. They often manage searches themselves, bringing deep knowledge of the specific value creation plan and leadership attributes required.

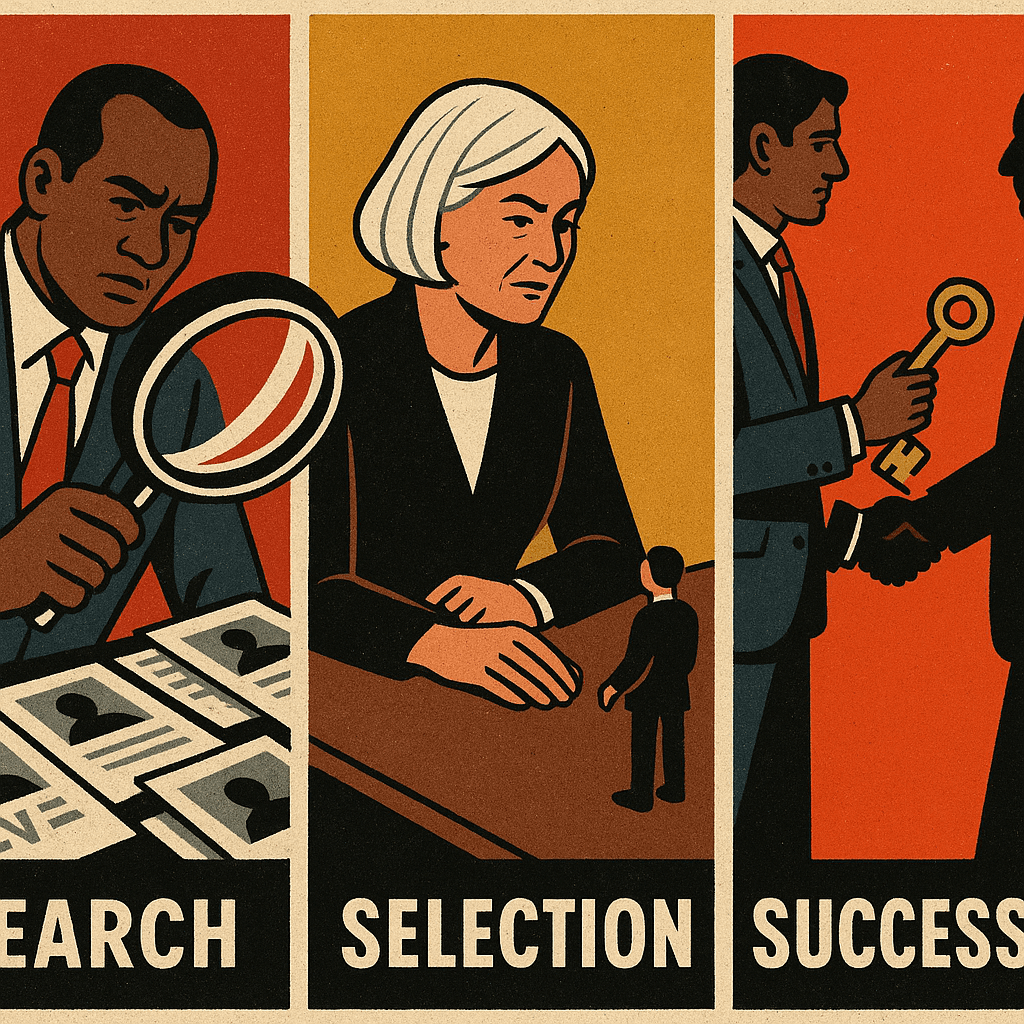

Summary: The Three Faces of Senior Finance Search

So, the next time a senior finance opportunity emerges, the shortlist is likely being curated by one of these three core players:

External Executive Search Consultants: Operating within the fragmented market of global firms, specialists, and boutiques.

Internal Executive Talent Teams: Handling significant senior volume within large corporations.

PE/VC Talent Partners: Driving leadership appointments within their portfolio companies.

Recognising who is behind the search can provide valuable context. They operate with different perspectives, priorities, and networks. In our next piece, we'll delve deeper into the external market, demystifying the different types of search firms, from the global giants to the niche boutiques.